Machine Learning Health Actuary

Summaries of data and empirical work can be found in the two accompanying Jupyter files. Arthur CHARPENTIER - Big Data and Machine Learning with an Actuarial Perspective - IABE A Brief Introduction to Machine Learning and Data Science for Actuaries A.

Ai To The Rescue The Actuary Magazine

Charpentier UQAM Université de Rennes 1 Professor of Actuarial Sciences Mathematics Department UQàM previously Economics Department Univ.

Machine learning health actuary. This makes supervised learning tasks a natural place for actuaries to initially explore machine learning techniques. One way machine learning can add value in the existing Dutch healthcare landscape is in analyses to subpopulations eg. Register by August 16 2021.

Data Science Overview 5. Actuaries are responsible for making correct modeling choices using their deep subject matter expertise. Understand the frontiers of actuarial application in this exciting new area.

With advances in cloud storage and cloud computing actuaries are in a position to leverage their current skills to new areas within and outside of traditional roles at insurance companies. Value of machine learning can be limited. RemitRix was founded to harness Machine Learning and bring an agile approach to delivering Solvency II compliance solutions.

Rennes 1 ENSAE Paristech actuary. This report details the use of cloud computing and machine learning in the actuarial profession. Machine Learning is finding applications in many areas of actuarial analysis including understanding and incentivizing provider behavior.

The Society of Actuaries is pleased to make available a research report that provides a literature survey of methodologies applying machine learning to insurance claim modeling. Insurance companies are investigating the possibility of applying these models in the areas of pricing fraud detection and reserving among other things but for these purposes more traditional actuarial models such as linear or logistic regression can also be used. Check it out and Apply Today.

The Dutch risk equalization model estimates. ML is a field of predictive analytics that focuses on ways to automatically learn from the data and improve with experience. In the near future image recognition may have a place in the.

Machine learning models are on the rise within the field of insurance. See thousands of other actuarial jobs. In machine learning Actuarial Data Science Manager Members of Modelling Analytics and Insight from Data MAID working group working on applying new techniques to traditional actuarial areas MAID now replaced with data science member interest group.

It does so by uncovering insights in the data without being told exactly where to look. ML is the GPS for actuaries. Actuaries should start adopting other techniques such as Machine Learning ML.

Cloud computing and machine learning uses in the actuarial profession. The report was authored by Alex Diana Jim Griffin Jaideep Oberoi and Ji Yao. Unsupervised learning Unsupervised learning covers a variety of techniques which have been designed to solve distinctly different types of problems.

Born out over 60 years cumulative experience in the insurance industry it is clear that change is coming and faster than at any point in the last century. Artificial Intelligence and machine learning models have grown in both sophistication and complexity and have demonstrated impressive accuracy and allowed deeper insights into claims morbidity customer stratification and consumer behavior to name a few. Machine Learning Overview 26 October 2018.

Pushing new actuary generations for using Machine learning BD BDC Findings Evolving data regulatory environment scrambles the way to use external data sources in insurance offers products Data Quality and Traceability are strong requirements and customers behavioral knowledge highlights the. Big data and predictive analytics have already created insights on risk particularly for personal property and auto insurance. As actuaries we hear a lot about big data predictive analytics machine learning and artificial intelligence AI.

Jason Reed is a health actuary and statistician at Optum specializing in. We aspire to be a game changer in the solvency world in a way that risk managers and actuaries build and manage their internal.

Machine Learning And Life Insurance Helping The Consumer The Actuary

Dat203x Data Science And Machine Learning Dat203x Data Science And Machine Learning Actuaries Digital

Are Data Scientists Learning To Become Actuaries Are Data Scientists Learning To Become Actuaries Actuaries Digital

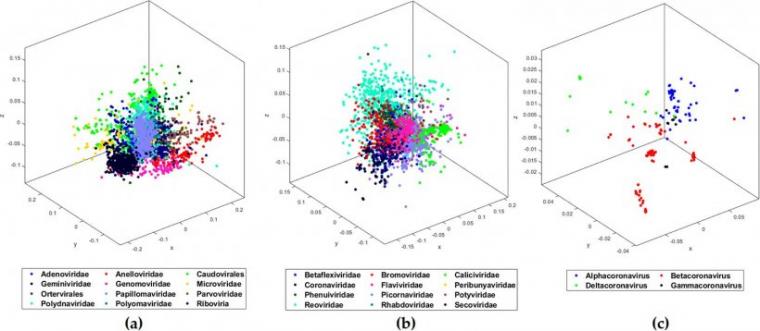

Machine Learning System Crack Covid 19 Genome Signature Tectales Tagging Medical Technology

Amazon Com Effective Statistical Learning Methods For Actuaries Ii Tree Based Methods And Extensions Springer Actuarial 9783030575557 Denuit Michel Hainaut Donatien Trufin Julien Books

Model Behavior Applications Of Artificial Intelligence In Actuarial Science Contingencies Magazine

Machine Learning In Insurance Nielsen Jens Perch Asimit Vali Kyriakou Ioannis 9783039364473 Amazon Com Books

Optimized Capital Risk Management For Insurance Companies

Actuarial Data Science Quantee

Https Www Aktuarai Lt Wp Content Uploads 2018 06 Actuary Vs Artificial Intelligence Pdf

Actuarial Data Science Quantee

Machine Learning In Insurance Do Actuarial Models Trust The Data Too Much Datarobot

Machine Learning In The Healthcare Sector

Artificial Intelligence And Machine Learning In Insurance Sector

Machine Learning In Insurance Do Actuarial Models Trust The Data Too Much Datarobot

Machine Learning The Deep End The Actuary

Machine Learning In Insurance Are Actuaries Missing Out On Missing Values Datarobot

How To Become A Health Care Actuary Regis College Online

Post a Comment for "Machine Learning Health Actuary"