Machine Learning Portfolio Optimization In R

Deep learning models to directly optimize the port-folio Sharpe ratio. After this introduction we will.

Machine Learning For Factor Investing R Version Chapman And Hall Crc Financial Mathematics Series 9780367545864 Economics Books Amazon Com

In this article we will use R and the rmetrics.

Machine learning portfolio optimization in r. To create an S4 object of class fPFOLIODATA we use the function portfolioData. The optim function in R can be used for 1- dimensional or n-dimensional problems. Mean returns I CovX.

Dont worry I will simplify it and make it easy and clear. Knowing how much capital needs to be allocated to a particular asset can make or break an investors portfolio. Fundamental terms in portfolio optimization.

Professor in the Machine Learning Research Group at the University of Oxford in Oxford UK. Thus these models can further improve the out-of-sample performance of existing models. Min w2Rp w w st.

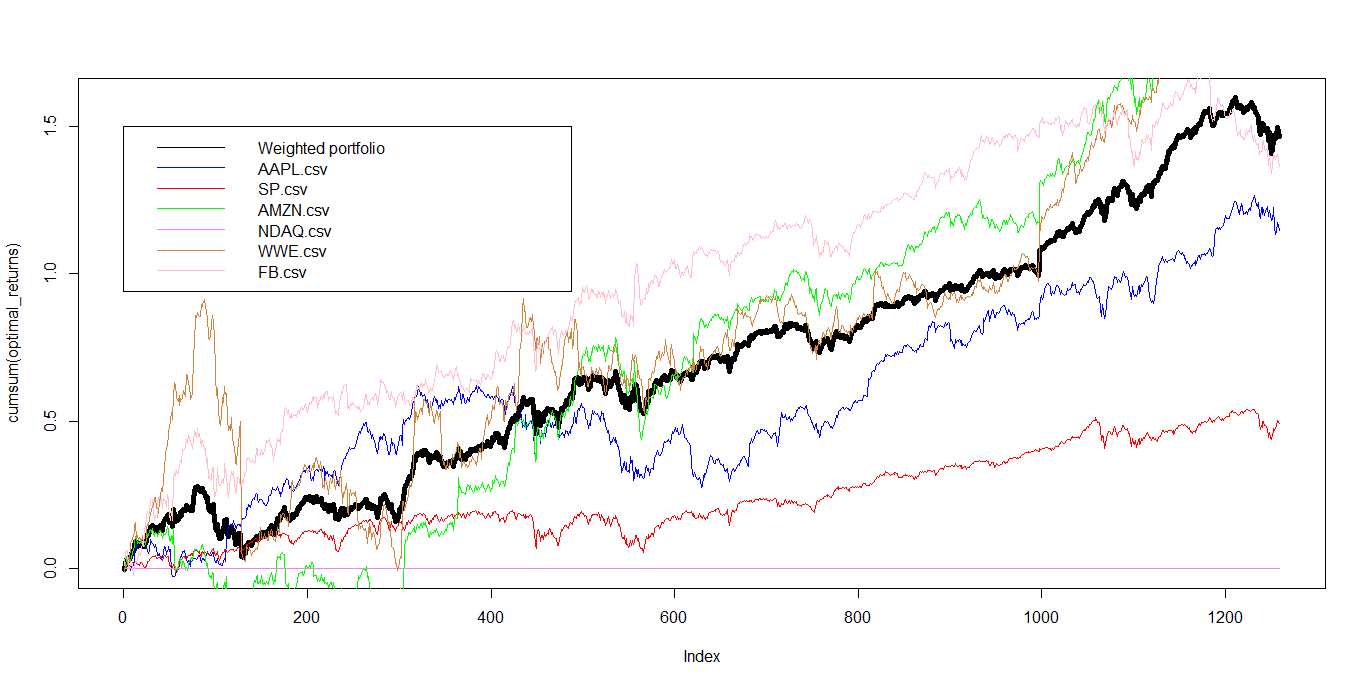

Now that you understand the term of portfolio optimization lets see how its actually implemented. To minimize the variance w Σ w subject to w e1 and w μq q is the expected rate of return. Portfolio Optimization Consider the portfolio optimization problem Markowitz 1952.

We define the portfolio selection problem as. µx ERx xµ whereas its variance is equal to. And short selling is prohibited.

For a given portfolio weight w expected return and variance are respectively wμq and w Σ w. Given a set of equities and a target return find an allocation to each equity that minimizes risk. Machine Learning Optimization Algorithms Portfolio Allocation i.

This course builds on the fundamental concepts from Introduction to Portfolio Analysis in R and explores advanced concepts in the portfolio optimization process. The purpose of portfolio optimization is to minimize risk while maximizing the returns of a portfolio of assets. These advanced portfolio optimization models not only own the advantages of machine learning and deep learning models in return prediction but also retain the essences of classical MV and omega models in portfolio optimization.

In this lesson we are going to look at the following portfolio optimization problem. Representing data with timeSeries objects With S4 timeSeries objects found in the rmetrics package we can represent data for portfolio optimization. In this article the authors adopt.

I am unfamiliar to portfolio optimization. To address this we adapt two machine learning methods regularization and cross-validation for portfolio optimization. In the text volatility was the microstructure component used but other components such as order arrival rates liquidity can be substituted into the framework.

Student with the Oxford-Man Institute of Quantitative Finance and the Machine Learning Research Group at the University of Oxford in Oxford UK. Machine Learning Trading Portfolio Optimization and the Efficient Frontier 6 minute read Notice a. Artificial intelligence machine learning big data and other buzzwords are disrupting decision making in almost any area of finance.

The return of the portfolio is then equal to Rx P n i1 x iR i x R. W0R I Same if return constraint is relaxed to w R 290. The Stereoscopic Portfolio Optimization Framework introduces the idea of bottom-up optimization via the use of machine learning ensembles applied to some market microstructure component.

The general format for the optim function is -. Let µ ER and Σ E h RµRµ i be the vector of expected returns and the covariance matrix of asset returns. Deep Learning for Portfolio.

The expected return of the portfolio is equal to. There are some statistical terms required in optimization process without which an optimal portfolio cant be defined. I want equally weighted.

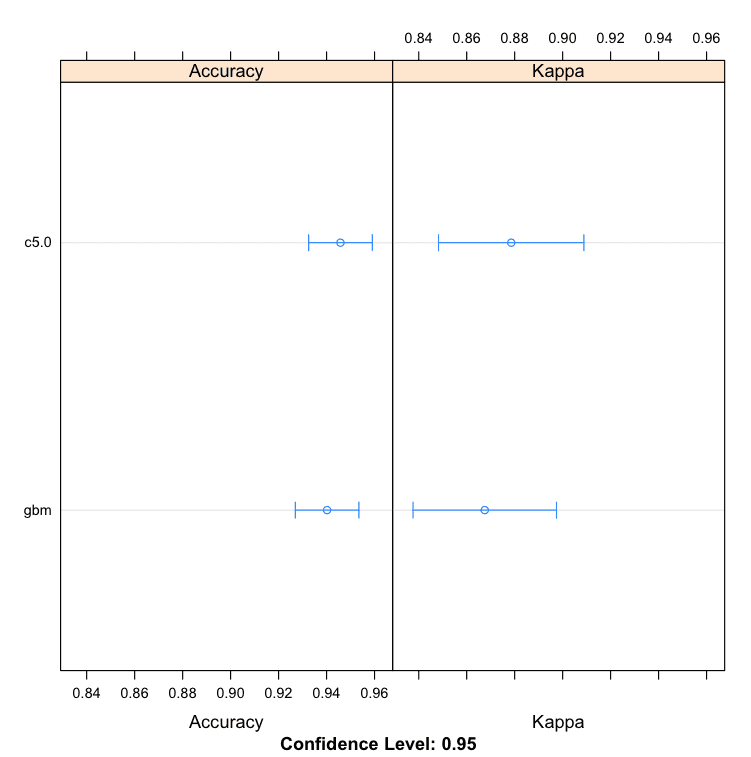

P 1 random vector of relative returns I EX. It is critical for an analyst or portfolio manager to understand all aspects of the portfolio optimization problem to make informed decisions. In the first part of this webinar we will review the most common ways to conduct the task of portfolio optimization with R.

P p covariance matrix for the relative returns I Solution. Equal risk contribution portfolio optimization function. Optim objective constraints bounds NULL types NULL maximum FALSE We start off with an example lets define the objective function what we are looking to solve -.

W R w1 1 MV where I X. Is an associate professor research with the Oxford-Man Institute of Quantitative Finance and the Machine Learning Research Group at the University of. The portfolio optimization model has limited impact in practice because of estimation issues when applied to real data.

Pin On Big Data And Advanced Analytics

Roc Curves Data Science Curves Predictive Analytics

Xgboost Using Gridsearchcv In Python Data Science Recipes Data Science Data Scientist Optimization

How To Use Xgboost Algorithm In R In Easy Steps Data Visualization Tools Data Science Algorithm

How To Build An Ensemble Of Machine Learning Algorithms In R

Ai For Portfolio Management From Markowitz To Reinforcement Learning By Alexandr Honchar The Startup Medium

Machine Learning Mastery With R

Scaled Agile Assessments Safe Agilehealthradar Agile Project Management Tools Agile Software Development Machine Learning Methods

Optimizing Tensorflow Serving Performance With Nvidia Tensorrt Machine Learning Models Optimization Deep Learning

Introducing The Ultimate R Cheat Sheet Version 2 0 The Shinyverse

Rstudio Ai Blog Deep Learning With Keras To Predict Customer Churn

Radars Agility Health Radar Project Management Tools Machine Learning Projects Learning Projects

Machine Learning Models Ppt Free Download Now Machine Learning Models Machine Learning Methods Machine Learning

Portfolio Optimization In R Using A Genetic Algorithm By Gianluca Malato The Trading Scientist Medium

Authors Dr Thomas Starke David Edwards Dr Thomas Wiecki Introduction In This Blog Post You Will Learn About The Bas Optimization Marketing Data Stock Data

Package Funmodeling Data Cleaning Importance Variable Analysis And Model Perfomance Analysis Data Data Science

Post a Comment for "Machine Learning Portfolio Optimization In R"